- Fixed Fee Quotes & No Hidden Charges!

- Faster completions with our “Express Conveyancing Service!”*

- Select a quote type (e.g. Sale/Purchase) & enter property details

- Review recommended quotes from our nationwide panel

- Review price, ratings, reviews, & location

- “No Move No Fee

- “Instruct” & receive the solicitor’s digital sign up documents with no obligation

Instant online conveyancing quotes

- Fixed Fee Quotes & No Hidden Charges!

- Faster completions with our “Express Conveyancing Service!”*

- Select a quote type (e.g. Sale/Purchase) & enter property details

- Review recommended quotes from our nationwide panel

- Compare solicitors by price, customer ratings, reviews, & location

- “Save” or “Instruct” your favourite quote(s)

- “Instruct” to view solicitor’s terms with no obligation.

- No Move No fee

1st class experience. Punctual, clear, and precise and nothing is a problem. Thoroughly recommend.

John Ellison

Compare Instant Conveyancing Quotes

- Founded by leading independent legal experts

- Cherry-picked solicitors and individual conveyancers

- Trusted by clients, agents, & brokers nationwide

- FREE support from start to completion

- No Move No Fee & Fixed Fee Quotes

- Instant Quotes Including Reviews

- 24/7 support via phone, email, & SMS

- Unique service created by My Legal Club

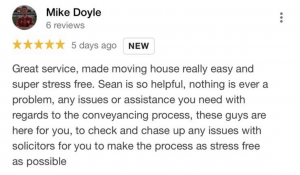

Happy Clients

We track your case & provide 24/7 support from start until completion

Conveyancing Quotes

Our instant online conveyancing quotes are fixed fee, no-obligation, & include no hidden charges!

Cherry-Picked Solicitors

We select & monitor UK leading solicitors accepted by every lender with leading accreditations & awards!

5* Conveyancing Service

Expert solicitors, a stress-free system, 24/7 communication, 100% efficiency, & unrivalled value.

Designated Conveyancer

You will be assigned a dedicated conveyancer experienced at working with us and approved by our independent experts!

Full Support

We support you every step of the way. Any issues, questions, or queries we will handle from start to finish.

We make sure you

secure the right solicitor

If you do NOT instruct the right solicitor you risk significant delays.

If the person you instruct is not acceptable to the lender then this can cause significant delays and costs to you. The leading solicitors are not just regulated by the Solicitors Regulatory Authority (SRA), they also hold CQS accreditation via the Law Society, and should be Lexcel accredited (or at least working towards it). Lexcel accreditation is not easy for a solicitor to secure and shows they operate to a very high standard. Solicitors with CQS and Lexcel accreditation must have met, and continue to meet, extremely high standards of service.

We select, monitor, police, and assess the performance of our solicitors every month. We do not have to work with the solicitors we have cherry picked but we do so for a reason.

They deliver the best service to our clients.

What sets us apart?

We make it a simple process

STEP 1

Compare Quotes

Complete the quote form and compare solicitors by price, location, rating, and status

STEP 2

Instruct

Instruct one of solicitors who will then contact you with further details and advice with no-obligation

STEP 3

Free Benefits & Details

If you like what you see and sign up with them we will send the FREE benefits and further details to you via email

STEP 4

Work Commences

The solicitors start work on your conveyancing matter via their 5* service

STEP 5

24/7 Support & Advice

We are here 24/7 if you have any queries or issues during the legal process

No. 1 conveyancing

offer in the UK

No one else in the market offers 5* solicitors, with our level of support, and range of FREE benefits we provide our clients.

When you compare instant online conveyancing quotes it is important to note the quotes we provide are all-inclusive fixed-fee quotes with no hidden charges. Please be aware that other companies may only advertise their headline legal fees price, deliberately not including the additional expenses and disbursements which will be charged in the future, leading to misleading quotes

A conveyancing quote should include a fully itemised breakdown including the legal fees, any additional expenses, disbursements, and VAT. Check out our definitions guide by clicking here for further details on what these items are and why they appear on a quote.

Instant Online Conveyancing Quotes

FAQ’s & Definitions

How do you select the solicitors to include on the quotes?

My Legal Club has carefully cherry-picked a bespoke panel of the leading conveyancing solicitors across the UK.

There are two key aspects to how we choose our solicitors.

1) how we select solicitors to join our panel

2) how we select which solicitor is best suited to you

The group of solicitors we work with are unique as we cherry-picked the solicitors ensuring they are:

- Experienced solicitors regulated by the Solicitors Regulatory Authority (SRA)

- Accredited by the Law Society Conveyancing Quality Scheme (CQS). This is vital as many lenders will not work with a conveyancer who is NOT CQS

- Highly recommended by other customers with high customer ratings and reviews

- Constantly monitored by us. We monitor customer service, average quote size, speed of completion, amongst many other factors. We can expel solicitors from our panel if they do not meet the 5* service standards we expect for our clients.

- Committed to a level of service we have made every solicitor sign ensuring our clients receive a 5* level of customer service

You can compare quotes by price, location, online reviews, and legal-ready status.

What does legal ready mean?

Our definition of “legal ready” is a solicitor who offers digital starter packs. This means that you can provide identification documents, proof of address, and sign up to a solicitor using your smartphone or email. It is 100% safe and secure and compliant. Many solicitors waste weeks to simply open a file and request information from you via post with a stamped addressed envelope as they rely on traditional post services (which you can request if you wish). Our solicitors combine legal expertise with the latest modern technology to ensure you get the best of both worlds.

How long does a remortgage take? How long does conveyancing take?

It is important to remember that your solicitor will want to complete the legal process as quickly as possible. None of our solicitors will sacrifice customer service and communication for speed as our focus is a 5* service.

It is important to remember though that the solicitors do not receive their fees until the process is complete so it is not in your solicitor’s interest to delay matters.

With remortgages, the industry average is 4-8 weeks but we have seen cases complete within 2 weeks.

With buying and selling houses the industry average is 12 weeks but again we have seen our solicitors complete much quicker than this. The main problem with any form of conveyancing is the delays incurred by people or other businesses which are out of your control e.g.

- You may be in a chain if buying and/or selling a house and other people can slow this down

- If you are using a lender to provide a mortgage or remortgage they can often hold things up

- Clients themselves sometimes delay matters by not having the paperwork ready or available

- If searches are required then delays can be suffered depending on the organisation processing the searches

Do I need a local solicitor?

No, you do NOT need a local conveyancing solicitor.

There are three misconceptions about using a local conveyancing solicitor, namely:

- The solicitor knowing the area may help

- I may get a cheaper quote as I am local

- It will result in the conveyancing completing sooner

- It is more convenient for me if I can just pop in and see my solicitor

Whether you choose a local solicitor is a different matter but you do NOT need your solicitor to be local.

Our solicitors can secure your identification document using modern methods meaning they do not need to have your identity verified in old fashioned ways (e.g. by visiting the solicitor’s office in person).

The location of the solicitor is irrelevant. Any local knowledge has no impact upon the conveyancing process which is heavily transactional and document-based.

On the contrary, in our experience when researching potential solicitors to join our panel, a lot of local conveyancing firms are more expensive than their national counterparts. We believe many local firms know that some clients are not going to research the market and are going to contact their local solicitor. In addition, the less work a solicitor receives the greater the pressure is to increase prices to make ends meet.

The speed in which conveyancing completes depends on a number of factors so the location of a solicitor is irrelevant. Any chain and the pace at which they move, along with any issues caused along the chain, your own efficiency in responding to queries and providing information, along with time spent waiting on surveyors, lenders, and for search results, etc mean there are a lot of factors which impact upon the speed of a conveyancing transaction.

There is no need for face to face meetings or visits in a conveyancing transaction. The only benefit we can think of is that rather than sending documents to the solicitor via stamped addressed envelope you can hand them in the solicitor directly. This apart there is no extra convenience gained by selecting a local solicitor.

Why are the legal fees associated with conveyancing different with each solicitor?

The majority of solicitor’s legal fee pricing is pretty similar. Where a solicitor is based, how good their internal systems and software are, their business model, and a number of other factors impact upon what price a solicitor will provide for a quote.

There are three factors to consider in any quote:

1) The solicitor’s legal fee (profit costs)

2) Is the solicitor providing a full quote with no hidden charges? Sometimes quotes can appear cheaper because the quote has not been provided in full

3) There are disbursements (additional fees) and supplementary fees required to complete the process which is not related to the solicitor’s legal fee. Examples are:

- Stamp duty fees

- Land Registry fees

- BACS (cost of the banking transfers)

- Searches (local searches etc)

- VAT on the legal fee

When you generate instant online conveyancing quotes you will receive a full breakdown of the fees within an all-inclusive fixed fee quote.

When do I need to pay my solicitor conveyancing fees?

1. The solicitor’s legal costs are usually paid for at the end. E.g. when the process is completed.

2. Some disbursements (e.g. transactional fees) such as local searches or official copies will be paid for up-front by you. You will have received confirmation of these within any quote before you instructed the solicitor. Other disbursements are paid at the end.

3. Some solicitors ask for some money up-front e.g. 10% of their legal fees but most do not.

What does a quote look like? Why is there a list of other fees?

Quotes can be misleading. Some companies only quote you for their fees to make the cost seem attractive. This quote may not include their VAT and/or the disbursements.

What are disbursements? Disbursements are the fees which you must pay for, not limited to but including, bacs transfers, land registry fees, fees for the searches, etc. Many companies leave these items off resulting in you receiving a bigger invoice than you expected. Make sure your quote includes all VAT and disbursements to ensure you have accurate information and can budget correctly.

An example of the quote headings when buying a house is below:

Legal Fee

VAT

Disbursements & Supplementary fees:

(such as)

Land registry fees

Stamp Duty (if applicable)

Search Pack

OS1 search

Bankruptcy search (per name)

ID check (each one)

Electronic file holding

CHAPS

There are sometimes additional fees (not disbursements) that are added by the solicitor based on the questions you answer as part of the quote process. As an example, it may be because of the number of people being named on the mortgage, whether the property is a new build, whether it is a part of a scheme, or even sold at auction.

Conveyancing definitions. What do all the key words and phrases mean?

Certificate of Title – Form submitted to a mortgage lender requesting mortgage funds once checks have been completed against the property.

Chain – The buyers and sellers involved linking the properties being bought and sold.

Completion – The date the transaction of buying/selling a house is legally completed. This is the day you move. This date will be set after contracts are exchanged.

Conditions of sale – The terms attached to the contract in which the buyer and seller agree to buy/sell the property.

Contract – A written and binding agreement between the buyer and seller including all information relating to the house sale/purchase transaction. You will exchange after completion dates are agreed upon.

Conveyance – A document transferring ownership of a property from a seller to a buyer.

Deposit – Money paid to sellers on the exchange of contracts

Disbursements – Expenses incurred such as Land Registry fees and searches

Early repayment charge – A payment to your lender for ending or repaying the mortgage sooner than the end of the term. This will be confirmed in your mortgage documents.

Environment Search – Search designed to reveal the presence and records of flooding, landfill sites, contamination, etc.

Exchange of Contracts – The date when contracts are exchanged and a date is agreed and confirmed for completion.

Fixtures and fittings – Items to remain in the property or to be removed.

Freehold – Freehold is a title explaining ownership. This includes all the land (unless otherwise stated) and is forever.

Ground Rent – A charge payable to the owner of freehold land on leasehold properties.

Guarantor – A person who indemnifies a borrower making the guarantor liable in any default by the borrower.

Indemnity insurance – An insurance policy to cover losses arising from title defects and mistakes.

Joint tenants – When owners own the property in equal shares.

Land Registry fees – A fee(s) payable for obtaining copy documents and registering changes of ownership of a property.

Land Registry – Responsible for recording ownership of land.

Lease – The document where a landlord contracts with a tenant in respect of a property for a fixed period. Any ground rent and service charges are confirmed, rent payable, and what you can do with the property.

Leasehold – Ownership of land for a term of years. Leasehold relates to the property.

Leaseholder – Also a tenant.

Local authority search – Are there any issues or regulations which restrict the property? As an example a conservation area, whether there are any proposals for new highways or public transport in the area, amongst many other items including any planning permission.

Mortgage Deed – The mortgage document.

Mortgage fees – Fees payable to your lender in respect of the arranging and administering of the mortgage.

Redemption figure – The amount needed to fully repay your mortgage.

Registration – Registering the updated property details with the Land Registry.

Search – Checks carried out against the property to reveal any problems or issues.

Stamp Duty – Stamp Duty Land Tax. Charged by the government on completion of buying a property.

Structural survey – A survey specifically looking at elements relating to the property and its structure.

Subject to Contract – An agreement prior to contracts

Tenants in Common – Similar to joint tenants but whereas with joint tenants if one person dies ownership transfers to the other owner with tenants in common upon the death of the first owner their share passes in accordance with the terms of their will.

Title Deeds – Document with background information about the property’s ownership history.

Transfer of Equity – Transferring ownership of property commonly when you get married or divorced. The “equity” transfers.

Valuation – Valuation of a property for the lender to value the property and help assess and calculate a mortgage.

What documents do I need to have ready for my solicitors when selling a house?

Not limited to but including:

1. Proof of identity and address

2. Energy performance certificate

3. Management information pack

4. Fittings and consent form

5. Existing mortgage details

6. Acceptance of offer

Instant Online Conveyancing Quotes

Complete the simple quote process and hit the “Instant Online Conveyancing Quotes” button to compare conveyancing quotes with no-obligation from our specialist cherry-picked solicitors.